BTC traded little changed while the dollar index fell, maintaining its post-Fed bearish momentum.

The US NFP report is expected to show the pace of job creation slowed in March.

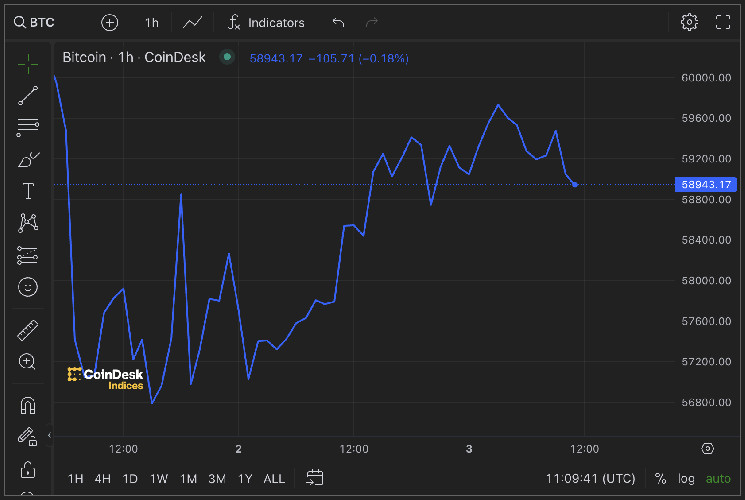

Bitcoin price sell-off has stalled since the Fed meeting on Wednesday, allowing for a slight price recovery. Further gains, at least in part, depend on upcoming US nonfarm payrolls data.

The US Labor Department’s nonfarm payrolls report due at 12:30 UTC is expected to show the world’s largest economy added 243,000 jobs last month following the addition of 303,000 jobs in March, according to Reuters. The unemployment rate is expected to remain below 4% for the 27th straight month, while average hourly earnings are expected to increase 0.3% month-on-month, matching March’s increase.

Ahead of the data, bitcoin (BTC) showed signs of stability, while the dollar index weakened. Fed funds futures show renewed expectations of a rate cut or easing liquidity in November.

The leading cryptocurrency by market value was trading near $59,000 at press time, up more than 4% from Wednesday’s lows near $56,500, according to CoinDesk data. The dollar index, which measures the greenback’s exchange rate against major fiat currencies, has fallen more than 1% to 105.20 after Fed Chair Jerome Powell ruled out raising interest rates as the next step in a press conference following the Federal Open Market Committee’s decision.

Thus, the upcoming jobs report could be a key event for markets, testing more optimistic bets on a Fed rate cut, according to ING.

“Our 210K call for payrolls means we do not expect today’s data to dampen the dollar’s bearish momentum as markets may fully price in a cut in September and hold US dollar interest rates in the short term,” ING strategists said in a note to clients.

CFTC data shows the dollar’s reported net-speculative position versus G10 currencies is at 24% open interest, the highest since June 2019, so room for further long-term pressure on the dollar remains large if US data weakens in the coming weeks. ,” added the strategists.

Continued dollar weakness could bode well for risk assets, including bitcoin. Cryptocurrencies tend to move in the opposite direction to the greenback, which impacts global liquidity conditions.