Last year, Virgin Galactic seemed to finally be hitting a stride toward making commercial suborbital spaceflight. The company flew its SpaceShipTwo rocket plane to the edge of space six times in six months, giving a few Virgin Galactic customers a taste of spaceflight after waiting more than a decade.

Finally, it appeared that Virgin Galactic turned a corner, moving past the setbacks and course corrections that delayed founder Sir Richard Branson’s aim of bringing spaceflight to a wider population. Virgin Galactic officials wouldn’t describe the company’s next step as a setback or a course correction. It’s part of an intentional business strategy to make Branson’s dream a reality.

“That dream behind Virgin Galactic came into sharp focus as we repeatedly flew spaceship Unity in 2023,” said Michael Colglazier, Virgin Galactic’s president and CEO, in a quarterly earnings call this week. “Now, in 2024, we’re poised for even more meaningful accomplishments as we build the fleet of spaceships that will turn the dream into reality and long-term success.”

But to do so, Virgin Galactic needs to give up on the horse that got them here.

On 11 missions, including test flights, the VSS Unity rocket plane has soared higher than 50 miles (80 kilometers)—where space begins, according to the US government’s definition—but it will probably fly just once more. Virgin Galactic is redirecting resources toward completing the development and testing of a new fleet of rocket planes known as Delta-class ships, which the company says will outclass VSS Unity in flight cadence, reusability, and revenue-earning potential.

Colglazier said the first of Virgin Galactic’s Delta ships is on track to begin ground and flight testing next year, with commercial service targeted for 2026 based out of Spaceport America in New Mexico.

One more and done

Late last year, Virgin Galactic announced it would retire VSS Unity by the middle of 2024, following the company’s Galactic 07 or Galactic 08 missions. On Tuesday, a company spokesperson confirmed to Ars that Virgin Galactic will pause flights of VSS Unity after the Galactic 07 mission slated for this spring. That means the rocket plane will fly to space just one more time, taking four customers into suborbital space to experience a few minutes of microgravity before coming back to land on a runway.

Colglazier said this next flight will have a “blended manifest of researchers and private citizens.” The company hasn’t identified any of the passengers, and for the last several flights, hasn’t announced the names of their passengers until after they landed.

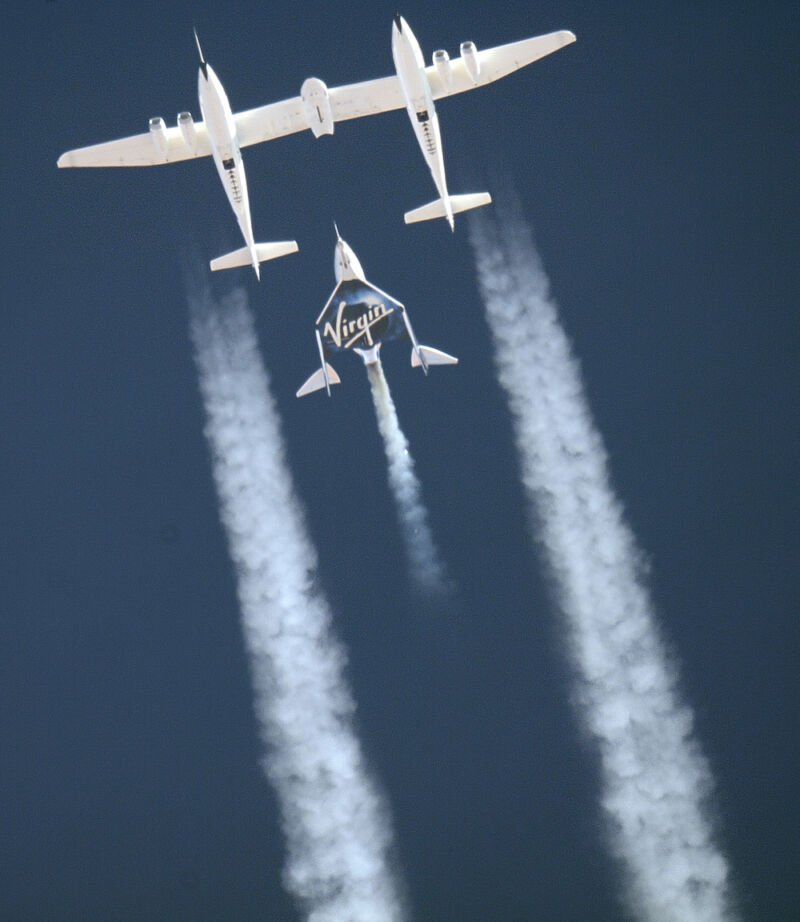

Mike Moses, Virgin Galactic’s president of spaceline operations, said the Galactic 07 mission, the final flight of VSS Unity, is scheduled for the second quarter of this year, sometime between the beginning of April and the end of June. He said engineers are looking at a “minor change” to a retention mechanism that malfunctioned on the Galactic 06 flight last month, causing an alignment pin to fall to the ground as the rocket plane separated from its carrier aircraft over New Mexico.

Virgin Galactic reported the anomaly earlier this month, but Moses said the alignment pin performed its function of keeping the VSS Unity spacecraft properly aligned to its carrier jet through pre-flight procedures until the rocket plane separated from the aircraft to fire its rocket motor and climb to the edge of space. The anomaly “posed no safety threat at all during the flight,” he said, but “clearly we don’t want it to fall.”

The reason for pulling VSS Unity off flight status boils down to money, not any technical limitation. In August, Moses told Ars that VSS Unity could be capable of 500 to 1,000 flights.

This week, Virgin Galactic reported its financial results for the fourth quarter of 2023. The company ended December with $982 million in cash or cash equivalents on hand, significantly more than other companies that went public during the so-called “SPAC craze” in the last few years. The company says this is enough funding to survive until the new Delta-class ships enter commercial service in 2026.

But Virgin Galactic continues to report low revenues, with $7 million in revenue recorded in all of last year. After taking into account operating expenses, the company reported a net loss of $502 million last year, almost the exact same financial loss it recorded in 2022. Since going public in 2019, Virgin Galactic’s market valuation has fallen from more than $2 billion to around $700 million today.

So, there’s a steep climb for Virgin Galactic to become profitable. Branson, Virgin Galactic’s founder, told the Financial Times in December that he was not planning any further investments in the suborbital spaceflight company. “We don’t have the deepest pockets after CVID, and Virgin Galactic has got $1 billion, or nearly,” Branson said. “It should, I believe, have sufficient funds to do its job on its own.”

Branson holds a 7.7 percent stake in Virgin Galactic through his Virgin Group business empire. Virgin Orbit, another startup Branson established to go after the small satellite launch market, went bankrupt last year.

Virgin Galactic is a long way from facing the same fate as Virgin Orbit, but VSS Unity was never going to turn the company into a moneymaker.

“This is the new way to make spaceships”

Virgin Galactic officials this week offered new details about the Delta-class ships it will build at a new factory near Phoenix. The Delta ships will look almost identical to VSS Unity, but they will accommodate six paying passengers, compared to the four customer seats on each VSS Unity flight. Two Virgin Galactic pilots will command the Delta ship on each flight, and the company will continue to use the same air-launch architecture.

“The dynamics of the flight, the shape of the vehicle, our pilot-led approach and our fundamental customer experience won’t change, but each of the aspects will be enhanced,” Moses said. “The spaceship system emphasizes safety first, and then ultimately, reusability and frequent flight rate.”

The Delta ships will be built using a composite resin material called bismaleimide, or BMI, that can withstand higher temperatures than the materials used on VSS Unity. Moses said this material change will allow Delta ships to fly with a lighter heat shield, improving cabin capacity for passengers and research experiments inside the vehicle.

Virgin Galactic’s goal is to fly each Delta ship eight times per month, an improvement over the once-per-month flight cadence achieved by VSS Unity. Many rocket companies aspire to operate their vehicles like airliners. Virgin Galactic’s strategy to achieve this goal is to build Delta ships like airplanes.

For Delta ships, Moses said Virgin Galactic will eliminate many of the inspections it performs between each Unity flight. The company has committed to a substantial upfront investment to build a Delta ship structural test article to validate component life and cycle limits for major components of the vehicle.

“We will then pull, push, bend, and twist that piece of structure until it breaks, verifying its capabilities compared to computer model predictions,” Moses said. “This type of testing is common in aerospace manufacturing, and it allows you to have high confidence in your limits and capabilities.”

The parts of the Delta ships that still need inspections will be easier for technicians to access in between flights. Ars previously reported on Virgin Galactic’s efforts to reduce turnaround times between spaceflights.

“A static test article represents a significant investment in time and materials, but the payoff is well worth it,” Moses said. “Similar to how modern airliners are maintained, the Delta fleet will have test data to inform the number and frequency of inspections that will be needed with the ability to space these out over the course of its lifetime. While Unity needed an average of 14 days of inspections between flights, the Delta fleet will only need less than a day.”

Inside the new factory in Arizona, Virgin Galactic will install automated tooling and introduce “digital twin” modeling technology that should make it easier to manufacture each Delta ship. VSS Unity was a “hand-built spaceship,” Moses said, while Virgin Galactic will rely on suppliers Bell Textron and Qarbon Aerospace to build “subassemblies” like wings, fuselages, and feathers for the Delta ships. Both suppliers primarily operate in the commercial aviation market, building helicopters and major composite structures for commercial and military aircraft.

These subassemblies will come together at Virgin Galactic’s final assembly plant now under construction near Phoenix. The “incremental” cost per Delta ship is in the range of $50 million to $60 million, according to Moses.

All of these design changes boil down to Virgin Galactic collecting more revenue per flight. “With six seats, these ships can deliver a revenue per flight of $3.6 million at current pricing levels,” Colglazier said. That’s roughly 12 times the revenue compared to a single Unity flight, Moses said.

With a fleet of four to five Delta ships and two carrier aircraft to tow them aloft, Virgin Galactic could reach a cadence of nearly one flight per day, after setting aside time for annual maintenance downtime and potential unforeseen delays, Colglazier said. This would generate more than $1 billion per year in revenue, according to Virgin Galactic’s numbers. The company is even looking at selling tickets for space enthusiasts to come to New Mexico and watch a Virgin Galactic flight in person.

Virgin Galactic will need new motherships to support the ambitious flight rate for the Delta ships, and the company hasn’t said much about when it will build those. The existing mothership, VMS Eve, could support early Delta flight tests.

Virgin Galactic could still reach positive cash flow with just two Delta ships, according to Doug Ahrens, the company’s chief financial officer. But until the Delta ships start flying on a commercial basis, Virgin Galactic’s revenue is likely to dry up. The company has apparently stopped work on an intermediate spaceship, named VSS Imagine, that would have bridged the gap between VSS Unity and the next-gen Delta ships.

For now, Virgin Galactic has stopped selling tickets for spaceflights, other than a handful of “house seats” available for referrals from other customers or founders. Colglazier said those seats are now sold for $600,000, up from the previous price point of $450,000. The new price for a space tourist seat is in line with what Virgin Galactic charges for a researcher, who comes with additional training and hardware requirements.

The original ticket price for a seat on Virgin Galactic was $200,000. The company says it has a backlog of 725 people waiting for a flight opportunity, but it won’t reopen sales until the Delta ships are closer to becoming operational. When ticket sales resume, Colglazier anticipates prices will be more likely to continue to go up.

Virgin Galactic had several seats open up on recent flights of VSS Unity, and the company sold those last-minute seats at what Colglazier said was a market price. “That’s been very close to $1 million,” he said, and is in line with the price for a seat on Blue Origin’s New Shepard spacecraft, Virgin Galactic’s only competitor in the suborbital human spaceflight market.

So, what’s the market for what Virgin Galactic is offering? The company estimates there are 300,000 people with the desire and money to fly to the edge of space with Virgin Galactic, and the number is growing at an annual rate of 8 percent. If this is true, Virgin Galactic might expand its operations to other spaceports in the United States or abroad.

But first, the company has to show it can actually build and fly suborbital spaceships like airplanes. This is a tall order, but even without Branson’s money, Virgin Galactic appears to have the financial runway to make an earnest attempt.