The Month of February has seen one of the most explosive bull runs on the crypto market in recent memory. From major coins like BTC and ETH, to altcoins and smaller projects, it seemed like the crypto market had gone into ‘bull mode’ in full swing.

As the likes of Bitcoin and Ethereum posted double-digit growth and the rest of the market followed, what does the month of March have in store for the market and is such a bullish momentum sustainable?

To answer these questions, we must look at the biggest winners and losers from the month of February to identify the potential reasons for this bull run and what other potential tailwinds lie ahead for the global crypto market in the coming months.

According to Edward Kendy, the Crypto Fear and Greed Index is an important gauge of market sentiment, which reads a value of 90/100, signaling extreme greed on the market. This increases the likelihood of a pullback in the coming months, as investors cash out on their gains from February.

Top 5 Gainers

February has been nothing short of spectacular for crypto investors, as it saw most of the market firmly in the green and some of the most popular coins delivering double and triple-digit growth to investors.

While such a momentum is challenging to maintain, there seem to be more tailwinds still up ahead, considering the Ethereum ETF news that are set to reach the public by late May of this year.

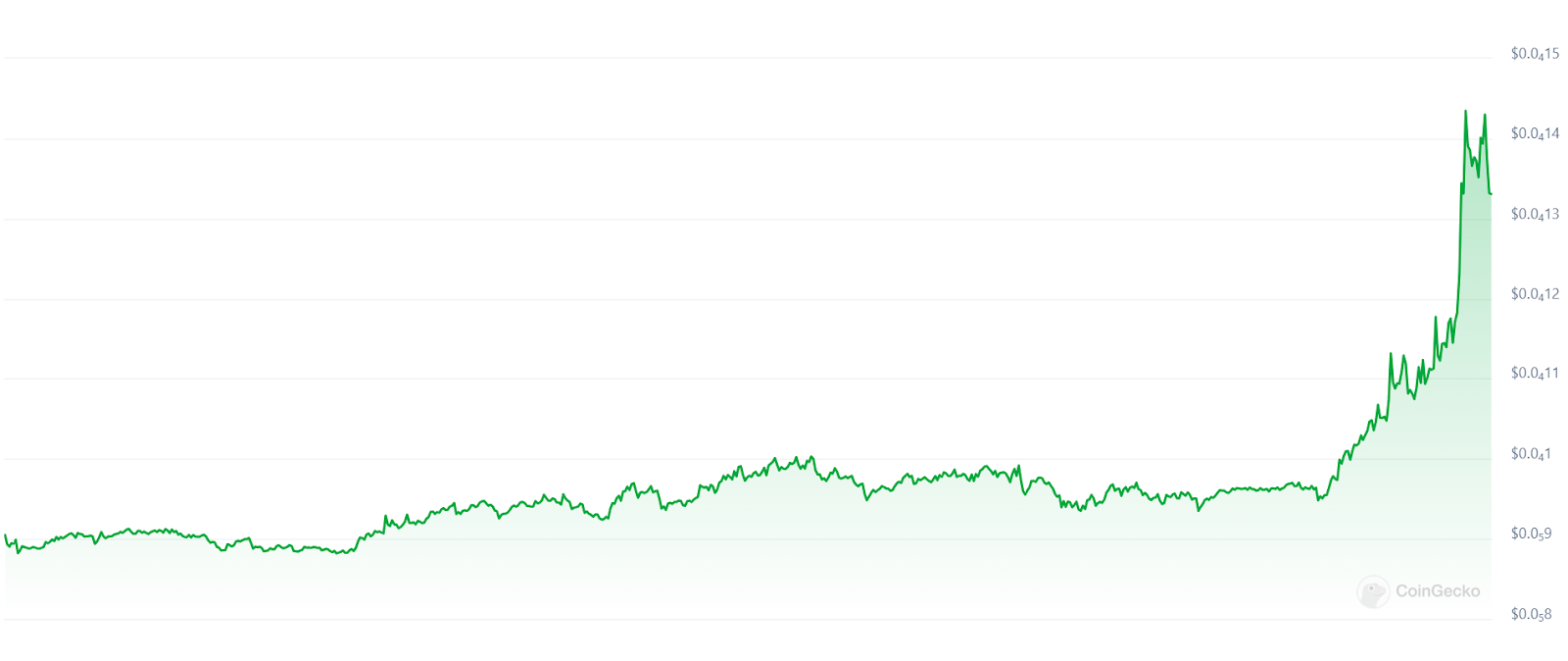

Shiba Inu (SHIB) +247%

Shiba Inu, which has been one of the fan favorites over the past few years, has exploded in February — more than tripling in price and delivering truly outstanding returns over the past month.

This incredible surge, which saw the price skyrocket by over 245%, has come off the back of general excitement regarding more institutional money pouring into th crypto space, as well as the entry of new ‘whales’ on the market, which saw contracts worth billions of dollars being filed on various exchanges and the market took note of this — triggering a buying spree on otherwise mixed-performing cryptocurrencies.

It is highly unlikely that such an exciting push will persist on SHIB going forward, but as current holders cash out on their gains and the price gradually dips, the market could very well brace for another go, which can lead to even higher prices in the coming months.

Uniswap (UNI) +85%

Up next is Uniswap, which has enjoyed a very fruitful month in February — climbing by as much as 85% over the past

Similarly to other cryptocurrencies on out list, Uniswap’s price jump was not dictated by positive news surrounding the project itself — rather, it was caused by a massive inflow of institutional money into Bitcoin and Ethereum, which comes off the back of positive spot ETF news that hit the markets in January.

While the near future for Uniswap seems quite positive, incremental sell-offs are likely to occur due to many holders, including whales, offloading some of their holdings and locking in profits before the next pullback.

Dogecoin (DOGE) +65%

Another fan favorite on the market, Dogecoin has been one of the most explosive cryptocurrencies of the past few years, with major upswings and downfalls being commonplace on its price chart.

The month of February has been no exception — in fact, DOGE jumped by a whopping 65% towards the end of the month, boosting its annual returns to an impressive 140% in the process.

However, some may argue that DOGE’s price is due for a correction and as the winners of the past month cash out their profits, Dogecoin is likely to face more headwinds heading into March.

Regardless, investors can expect more bullish momentum surrounding Dogecoin in the long run, as it is one of the most reactive cryptocurrencies when it comes to positive market developments.

Bitcoin (BTC) +40%

The flagship of the crypto industry, Bitcoin has been the driving force of the market since its inception. February has been a very successful month for BTC investors, who are coming off of positive news surrounding BTC spot ETFs, which allow institutions to issue equity instruments that directly hold Bitcoin, as opposed to its derivatives.

February saw the price of Bitcoin climb by 40% and reach over $60,000 — getting much closer to its ATH price, which greatly boosted optimism among long-term investors.

For those seeking to enter the market and buy Bitcoin, waiting for a sell-off can be more sensible, as the market is experiencing a period of elevated greed, which is likely to be substituted with a correction in the coming months.

Ethereum (ETH) +52%

February has been a great month for Ethereum investors as well, as the coin jumped by an impressive 52% and investors are hopeful of even more bullish momentum continuing in the coming months.

The Ethereum spot ETFs could hit the market by June 2024, which has made long-term investors considerably more optimistic regarding the prospects of the coin and the bullish run is unlikely to die down just yet. However, this does not suggest that a correction will not happen. In fact, it is highly likely that the price of ETH will experience double-digit decline before the next bull run picks up pace.

Overall, Ethereum is the one to watch in the coming months, with some analysts predicting the price to hit $5,000 before the end of 2024.

Top 5 Losers

Losers have been few and far between in February, as the market exploded into a bullish frenzy. However, there were a few exceptions that either underperformed in terms of growth, or outright lost value over the month.

Starknet (STRK) — 50%

Starknet is coming fresh off its ICO in February in what has been a disappointing first few weeks on the market for the coin, which is to be expected, as it entered the market during a frenzy and got overlooked by traders.

STRK fell from $3.50 to less than $2.00 over the course of just under 10 days, which might not set off any alarm bells just yet, as the project is incredibly young and its prospects have not yet been fully explored by the market.

A return of the bullish momentum seen in February could very well be the tailwind STRK holders have been asking for since the 20 Feb ICO from Starknet.

Monero (XMR) −17%

Monero is a popular cryptocurrency among online bettors and has long been one of the favorites of the investing community. However, the month of February has not been too kind for XMR holders, as the coin lost roughly 17% of its market value over the period.

The bulk of the decline came during the first week of the month and the coin slowly regained lost ground until the end of the month. This drop also greatly affects the annual returns of XMR, with only a 1% gain over the past 12 months of trading.

Investors of Monero will be hopeful of a replicated bull run in the future to turn their fortunes around and deliver positive results going forward. Whether this will be the case remains to be seen, but the upcoming tailwinds could be enough to boost XMR’s returns in March and beyond.

Sui (SUI) +0.20%

Sui has lagged firmly behind the bullish momentum of the crypto market in February — barely delivering any returns over the course of the month.

This comes at a stark contrast to the previous months of trading for Sui, with the coin returning over 400% since the end of October, 2023. This makes SUI one of the top-performing coins of the past few months.

Going forward, SUI is likely to continue on a downward trajectory, as investors lock in profits and cash out. However, this downturn is unlikely to be a lengthy process, as the market regains momentum and a bullish run continues.

Celestia (TIA) +1%

While Celestia has not lost value over the month of February, it sure lagged way behind its competition with just around 1% in monthly gain for the period.

As the bullish momentum persists, Celestia holders will be wondering if the coin will follow in the footsteps of the rest of the market or if this underperformance is a sign of very low interest from the broader crypto market.

It must be noted that Celestia’s long-term returns have been stellar so far — going from $2.30 by its ICO to as much as $20 in February, 2024. Therefore, TIA investors have more to be optimistic about in the long run and may chalk the inactivity of the past few weeks to a short-term shift in focus on the crypto market.

Internet Computer (ICP) +10%

While Internet Computer has managed to return double-digit growth in February, it has significantly lagged behind cryptocurrencies with similar market caps and trading volume, which may leave investors wondering what the coming months may look like for ICP.

ICP has been among the top gainers of the past 12 months, gaining over 200% over the period. October 2023 saw the start of the biggest bull run on Internet Computer, as the coin jumped from $3 to as high as $14 by the start of February.

Due to ICP’s long-term growth, the coin is likely to go through a correction before it continues to increase in price, therefore, investors should brace for a downturn in the coin’s price in the coming months.

Conclusion

February has been an amazing month for crypto investors, with most coins gaining massively over the period.

Bitcoin and Ethereum have emerged as the driving forces behind the market once again and

investors will be hopeful of the bullish momentum continuing in the coming months as well.

The Crypto Fear and Greed Index shows a value of 90/100, signaling extreme greed on the market, which may have resulted in overbuying from investors, which also increases the likelihood of a correction in March and April — bracing the market for major ETH news dropping towards the end of May.