Advertisement

What are AI tokens?

AI tokens serve as the currency for transactions within AI-powered platforms, enabling users to pay for services, access data, and engage in platform activities. Certain AI tokens also grant governance rights to holders, allowing them to participate in decision-making processes that influence the project’s development.

Often, AI tokens incentivize users to contribute to the protocol or project by rewarding them for activities such as providing data, offering computational resources, or developing AI applications.

Despite the recent hype, several metrics for the key AI tokens indicate further sector growth

AI crypto market overview

The AI token market has seen significant growth in recent months, with trading volumes and market valuations soaring across various exchanges. However, despite notable advancements in AI technology, this sector is still in its early stages.

The surge in AI-linked crypto tokens reflects the growing potential of this emerging asset class as the AI boom continues to influence the global tech landscape. This growth has been particularly noteworthy, outpacing even Bitcoin’s recent rally to a record valuation of $73,600.

On February 22, sector tokens surged by an average of 7.7%, with Ocean Protocol’s OCEAN and Fetch.AI’s FET rising over 10%. The CoinDesk 20 Index (CD20), tracking major cryptocurrencies, increased by 2.68% during the same period.

Worldcoin’s WLD saw the highest gain among AI tokens, soaring 30% to reach a new all-time high of $7. Founded by OpenAI CEO Sam Altman, Worldcoin’s rise is seen by some traders as a bet on OpenAI’s growth.

Ethereum co-founder Vitalik Buterin’s tweet about AI potentially auditing smart contracts boosted lesser-known tokens like 0x0 and TokenFi’s TOKEN, pushing them up by as much as 15% due to their association with the topic.

Despite the recent hype, several metrics for the key AI tokens indicate further sector growth.

Fetch.ai (FET)

Fetch.ai is a platform, that offers tools to build, deploy, and monetize AI services without altering existing APIs. It connects various integrations to create new services accessible through a single prompt.

Founded in 2017 and launched via Binance in 2019, is an AI lab based in Cambridge. Its platform, with a mainnet live since 2020, integrates decentralized machine learning on a distributed ledger.

The system uses autonomous software agents to optimize services, support IoT devices, and facilitate secure communication and automation. These agents can conduct searches, negotiate, trade knowledge, and share predictions and value independently.

Fetch.AI uses its native token, FET, as the primary currency for network transactions and services. FET is essential for accessing services, data, infrastructure, and AI algorithms on the platform. It is also used for registration, staking, and rewarding network participants. FET facilitates transactions within the Fetch.AI Open Economic Framework, enabling users to deploy agents and engage in network activities.

It was recently reported that SingularityNET, Fetch.ai, and Ocean Protocol are discussing merging their tokens into an ASI token valued at around $7.5 billion. This potential merger, which could be announced soon pending community approval, would establish a collaborative “Superintelligence Collective” led by Ben Goertzel of SingularityNET and chaired by Humayun Sheikh of Fetch.ai. Each platform would retain its operations while benefiting from collective collaboration.

Render Token (RNDR)

Render Token (RNDR) powers a decentralized GPU cloud computing network designed for high-demand tasks like AI/ML training and rendering. Users can stake and lock up RNDR tokens to access GPUs within the network

Render Farm suppliers are incentivized with RNDR tokens for leasing out their graphics processing capacity. As of the current time, RNDR has a market capitalization of $1.22 billion.

Render has carved out a unique niche in the AI ecosystem, positioning itself as a leader in the GPU distribution marketplace within the Web3 landscape. To further solidify its position, Render is strategically collaborating with key partners in the blockchain technology sector.

Despite market trends, Render has been defying expectations, highlighting its unique value proposition and recognition within the industry. As AI in blockchain continues to evolve, Render, alongside Fetch.ai, stands to gain a significant first-mover advantage as the industry matures.

Bittensor (TAO)

Bittensor aims to democratize AI development by creating a peer-to-peer ecosystem where users can create and deploy machine learning (ML) models. This platform allows different ML models to interact and learn from each other collaboratively, fostering a more open and inclusive AI development environment.

By integrating AI and blockchain technology, Bittensor offers a unique approach to AI development that harnesses the transformative potential of crypto in a responsible manner. This combination aims to break down barriers to entry in AI development, enabling broader participation and innovation in the field.

Launched in 2021 by the Opentensor Foundation, Bittensor is a relatively new project led by developers Jacob Robert Steeves and Ala Shabaana. The Opentensor Foundation drives Bittensor with the goal of establishing a connected and coordinated global supply of computing power to develop open-source and accessible AI technologies.

Bittensor operates on a network called “subtensor” connected to multiple “subnets,” with 32 subnets currently active. Users can create or join subnets, paying with TAO tokens to participate.

This competitive model encourages growth and high standards, allowing users to contribute as miners or validators based on their computing resources. Overall, it incentivizes participation and supports Bittensor’s decentralized AI ecosystem.

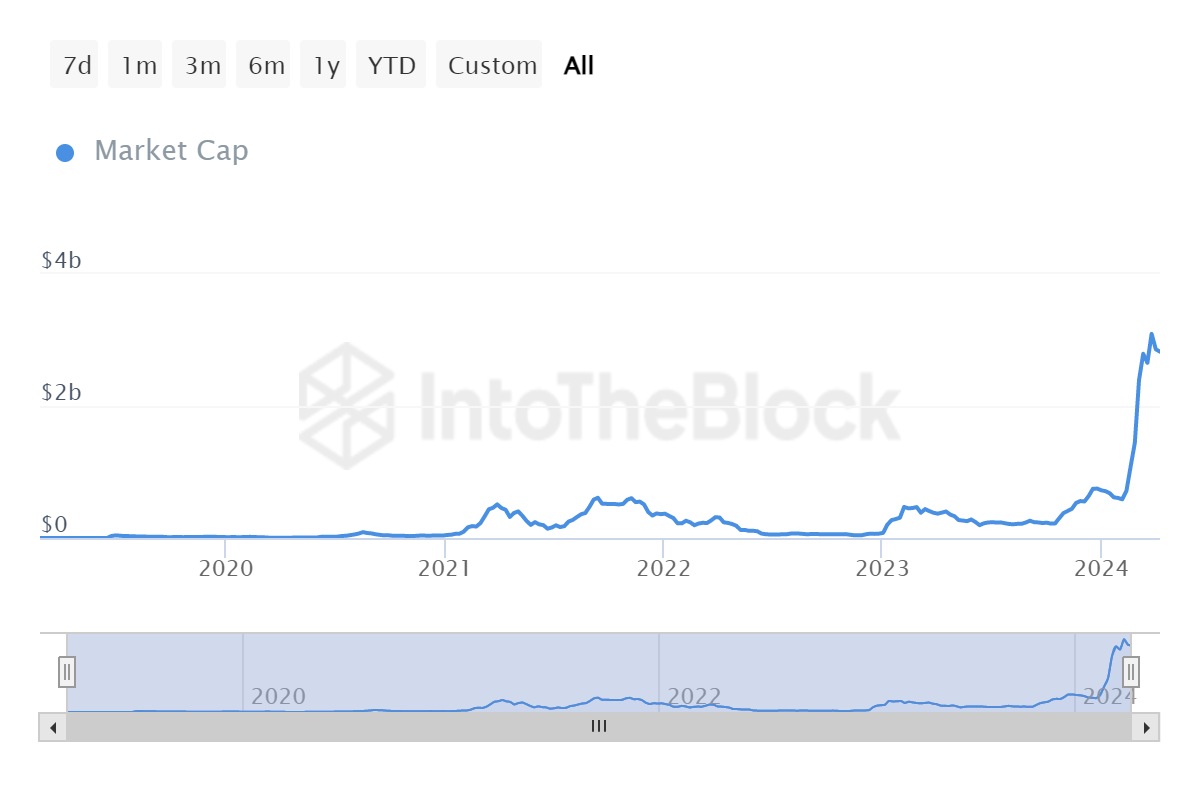

TAO has been among the winners of the current rally, with market cap soaring 500%.

Over the past week, TAO has seen an increase of over 18.0%, rising from $609.71 to its current price. The coin’s all-time high stands at $757.60.

Trading volume for Bittensor has climbed significantly by 643.0% over the past week, aligning with an increase in the overall circulating supply of the coin, which has grown by 0.7%.

The current circulating supply stands at 6.58 million tokens, representing approximately 31.32% of its maximum supply of 21.00 million tokens. As of now, TAO holds the #28 market cap ranking with a valuation of $4.68 billion.